Donating, the art of giving and receiving

Being a Friend of Todolí Citrus Fundació is much more than supporting a cultural and environmental project: it means playing an active role in a project that brings together culture, science and nature.

Your donation is not only a generous gesture with real impact.

It also pays back through personal satisfaction as well as offering significant tax benefits for individuals and companies alike.

Tax incentives

Todolí Citrus Fundació is a non-profit organization dedicated to the research, dissemination, and protection of citrus cultivation. It is registered with the Registry of Foundations of the Generalitat Valenciana (No. 586-V, since December 16, 2014) and classified as an environmental protection foundation.

Donations made to the Foundation are eligible for tax deductions under the provisions of Law 49/2002, as amended by Royal Decree-Law 6/2023.

Such contributions may be deducted either in your Personal Income Tax return or in Corporate Tax, as applicable.

Tax incentives for individuals

In the case of individuals, the donations and contributions you make to support Todolí Citrus Fundació can be deducted on your tax return.

The deductions from your personal income tax depend on the amount contributed. There is an 80% deduction for donations not exceeding €250 and a 40% deduction for the rest of the contribution above that amount.

Recurring donations

Individuals who have donated to Todolí Citrus Fundació for more than two years — with each contribution equal to or greater than the previous — are entitled to a 45% deduction on the amount exceeding €250, instead of the general 40%.

Deductions limits

The tax base – the amount to which the deduction is applied, may not exceed 15% of the taxpayer’s taxable income.

Residents in the Valencia Region

If you are a resident of the Valencia Region, you can deduct 20 % of the first €150 of your donation and an additional 25 % of the remaining value of your donation.

In-kind and professional service contributions

Since 2024 contributions in the form of professional services are also recognised as deductible donations. Likewise, in-kind donations may also benefit from tax advantages.

Non-residents

For individuals not resident in Spain who obtain income in the country, there is also a tax benefit for the amount of their donations.

hhh

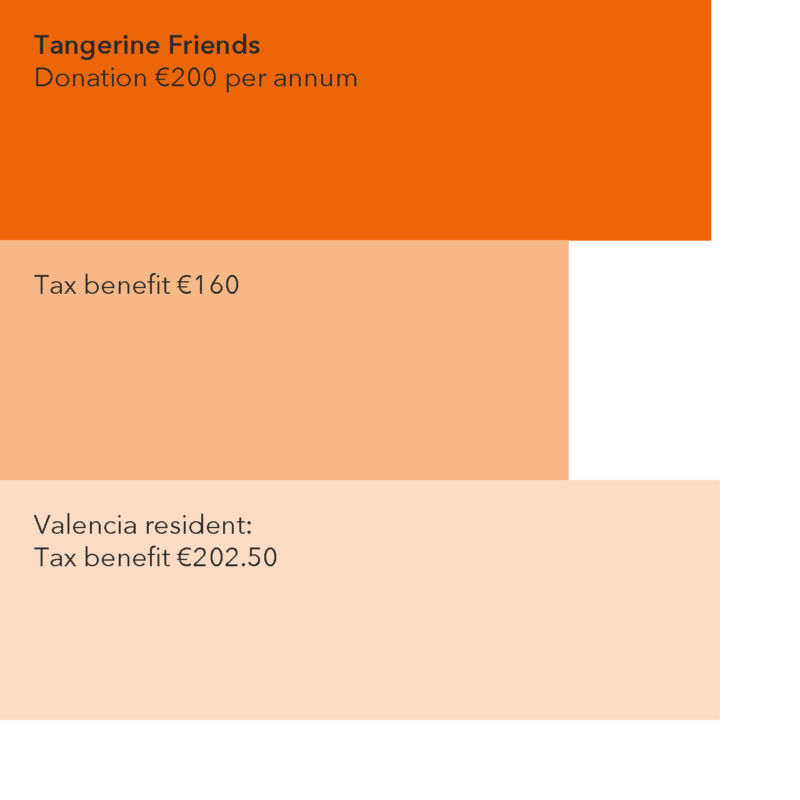

Tax refund

As a Tangerine Friend you can deduct 80% of your donation.

For a donation of €200, the tax refund is €160.

If you are a resident in the Valencia Region, you can deduct an additional €42,50. You’ll receive €202.50 back — more than your donation!

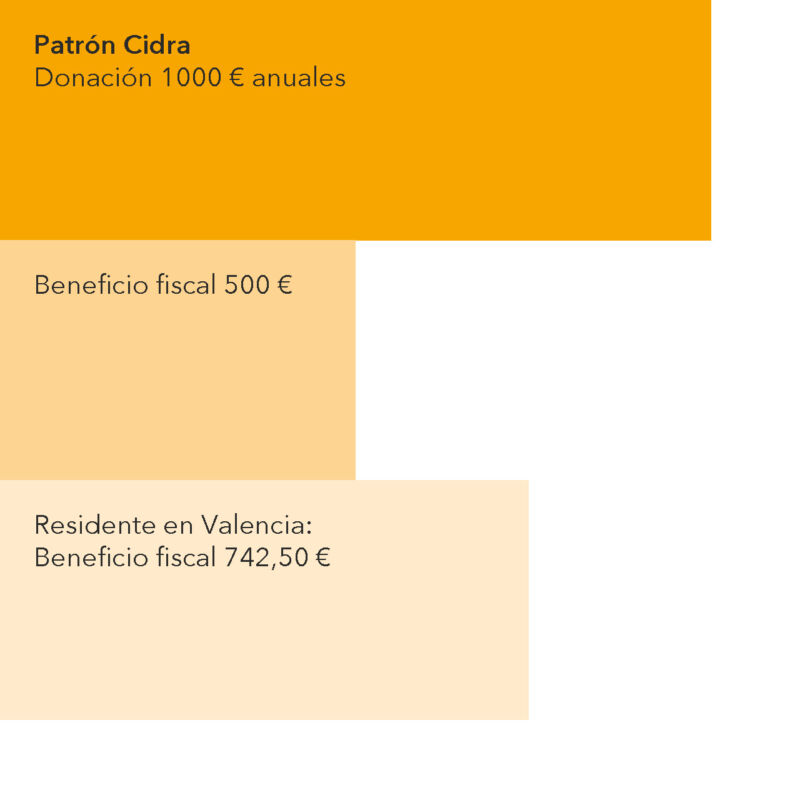

Tax refund

As a Cidra Patron you can deduct 80% of the first €250 of your donation plus 40% of the remaining €750. The tax refund is €200 + 300 = €500.

If you are a resident in the Valencia Region, you can deduct an additional €242.50. Therefore your total tax refund will amount to €742.50.

Tax refund

As a Bergamot Benefactor you can deduct 80% of the first €250 of your donation plus 40% of the remaining €4750.

The tax refund you are entitled to is €200 + €1900 = €2100. If you are a resident in the Valencia Region, you can deduct an additional €1242.50. Therefore your total tax refund will amount to €3342.50.

Tax incentives for companies

Tax incentives for companies

Legal entities that make donations to Todolí Citrus Fundació can benefit from a tax deduction on their corporate tax liability. The deduction is 40% for general donations and 50% for recurring donations. A recurring donation is considered to be a contribution of the same or greater amount made to Todolí Citrus Fundació the two preceding tax years.

Deduction limits

The deduction limit is 15% of the tax base – the legal entity’s corporate tax liability. However, if the limit is exceeded, the amounts not deducted can be applied in the tax periods ending in the current year and subsequent ten years.

In-kind and professional service contributions

As with individuals, legal entities may also deduct contributions in the form of professional services and in-kind donations.

Non-residents

For legal entities not resident in Spain who obtain income in the country, there is also a tax benefit for the amount of their donations.

Leaving your mark

Supporting Todolí Citrus Fundació means leaving your mark without asking for anything in return and receiving much more than you could have imagined.

In order to maximise the benefits of your donation and minimise any tax liability you might want to consider seeking the advice of a professional accountant or financial advisor.

If you’re interested in collaborating with us or sponsoring one of our activities or a specific project, feel free to write to us at amigos&friends@todolicitrus.org. We can design a tailor-made proposal aligned with your company’s needs and values.

Subscribe to our newsletter

We maintain information on events, news and other activities related to Todoli Citrus Fundació.